Tl;dr - When times are good, great companies have a small surplus of great people, with great skills, in the appropriate sales roles to drive growth. When times are tough, great companies have the right number of great people with recession-resistant sales skills to continue to grow. Regardless of the business season, it's critical to know what those skills are, who has them, and how many should be on the team!

Layoffs in the Headlines

You've seen the news. Layoff announcements include1,2,3:

Tech - Salesforce | 7,000 | 10% of employees

Tech - Paypal | 2,000 | 7%

Tech - Google | 12,000 | 6%

Tech - Microsoft | 10,000

But it's not just tech.

Finance - Goldman Sachs | 3,200 | 7%

Finance - Capital One | 1,100

Retail - Hasbro | 1,000 | 15%

Retail - Wayfair | 1,000 | 5%

Services - FedEx | 10% of managers

Industrials - Dow Chemical | 2,000

Industrials - 3M | 2,500

Now, not all of these jobs are in sales, although some certainly are. And these are only a portion of the jobs added by many of these companies in the past three years.

Technology tends to be a leading indicator. It's likely that the softening they're seeing and responding to will gradually impact other sectors - as capital investment tends to be a lagging indicator.

Of course, the news itself can be self-fulfilling as companies hesitate to make capital investments not because they've seen demand slow, but because they assume that the trends described in the news will affect them soon.

We know that eventually the trends playing out today in tech will impact industrial manufacturing more widely. We'll be reminded of the cyclical nature of capital equipment sales. There will be a couple of years of unhappiness.

But it's not all bad. Here are some actionable recommendations for ways capital equipment companies can use market circumstances to boost sales force effectiveness of their industrial sales teams.

Improving Sales Force Effectiveness Amidst Market Weakness

Many companies will retreat when the slowdown hits. They'll reflexively slash marketing and perhaps cut sales. Rather than reacting, though, let's take proactive steps that will strengthen performance today and as the recovery begins. These seven steps will help.

1. Recruit Available Talent

There will be great talent that becomes available - either laid off or tired of waiting for that to happen. With a continuous recruiting program, you'll identify many of them at a very low cost, and have the opportunity to bring some very talented sales reps on board - folks who might not have considered changing industries in the gogo days of tech. These additions - think folks from 2nd, 3rd or 4th standard sales talent deviations - will enhance your sales force effectiveness now and in the future.

2. Use Data to Make Hard Choices

When it's time to pare back your sales force, how will you decide who stays and goes? Pareto tells us that 80% of your team likely underperforms.

You could take the bottom 5% or 20% of performers as determined by who has missed their quota for the most consecutive periods. Or, you could make decisions based on seniority.

But there's a better way. How about selecting based on actual data - data that will help you empirically determine who will be most successful during the slowdown, and who will likely thrive as recovery begins.

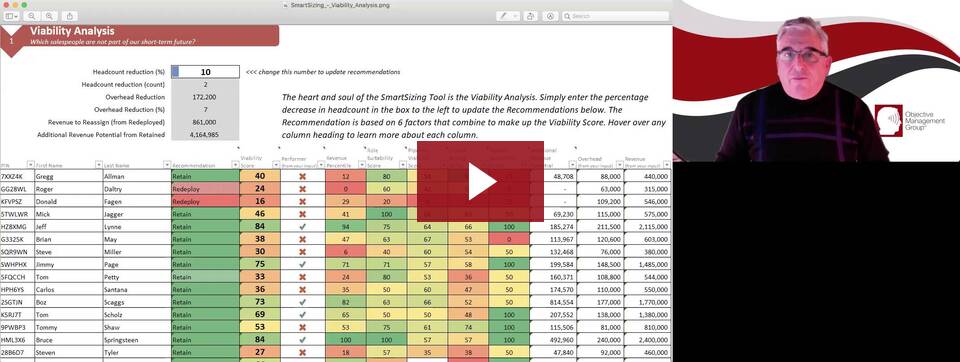

That's exactly what OMG's SmartSizing tool does. (check out the video for more detail)

That's exactly what OMG's SmartSizing tool does. (check out the video for more detail)

It gives you a flexible tool that is built on actual data with high predictive validity and includes adjustments for compelling circumstances.

3. Understand Who Has the Requisite Skills to Perform During Recession

For the last two+ years, sales reps who could process quotes and negotiate lead times have collected orders.

Those aren't sales skills. They're admin capabilities.

When the recession bites, only those with very specific, measurable sales skills and attributes will continue to consistently win deals. To cultivate sales force effectiveness, you need to know, rather than guess, who they are.

4. Key Accounts Will Understand

Many sales teams have a couple of folks that nurse some long-term relationships. Often they're high-priced account managers who maintain key account relationships.

When layoffs are widespread, it's an opportune time to provide those folks incentives to get back in the game and produce new business. If they fail, it's also a good time to prune those roles and assign those key accounts to others.

Buyers will understand when it's happening everywhere.

5. Emphasize Critical Skills & Process

There will be hard days and tough months. That's not fun for anyone, and it becomes discouraging and predictive for average players and teams. And yet some salespeople and a few sales teams manage to outperform even in crummy markets.

Why is sales force effectiveness so variable when many teams have comparable track records and resumes?

Because a few have the right skills as noted in #3 above....AND because they have a sound framework of an effective sales process and sales methodology, leading KPIs that accurately predict pipeline and revenue, great coaching, and enabling marketing.

Don't underestimate the power of coaching and training to consistently emphasize precision in execution, bolster confidence and motivation, and nurture success even as the market whispers in their ear that they should just accept the fact that the economy dictates their outcomes!

6. Create Killer Sales Enablement Content

It's going to take lots of emotional energy for your team to remain laser-focused, optimistic, appropriately active, and to succeed as the market gets tougher and more buyers simply freeze all spending and new projects.

Coaching, training, and positive motivation support will help. But they'll need more.

Sales enablement should include a set of tools to help them preempt common challenges they'll encounter. Clearly quantifying the cost of inaction will be critical to accessing frozen capital. Probably even more important will be tools to help reassure buyers that the risk of proceeding, even in seemingly perilous economic conditions, is lower than they may fear.

Your biggest challenge will be closing buyers who like your ideas and products, who believe that they will help them improve, but who believe the risk of implementation in the face of uncertain financial conditions is too high. They'' believe it's safer to "keep their powder dry" and keep the cash in the bank.

Put the challenge of overcoming that fear and uncertainty at the top of the list of priorities among your sales enablement strategies.

7. Exploit Competitors' Weaknesses

Prepare your competitive marketing folks to be much more active in updating battlecards. As competitors start to stumble under the strain of discounted orders, impaired cash flow, and deteriorating internal confidence, they'll react in new ways.

Your sales plays need to adapt to help your team preemptively prepare prospects for these behaviors.

Bonus - The Role of the Board

While corporate management, and sales and marketing leadership focus primarily on prudent financial decisions, revenue growth activities, and sales force effectiveness, the board of directors has another opportunity.

They should actively consider possible acquisitions and partnerships that will become possible as solid companies experience duress. Management and the board need to agree on who will perform corporate development functions if the company doesn't have that role established. Planning should include:

- exploration of financing options and parameters, and deal structures (acquisition, JV, etc.)

- defining acquisition thesis and goals (inorganic growth, move into adjacent markets, new products to sell to existing customers, acquisition of technologies, acquisition of market share, acquisition of a strong marketing machine, etc.)

- defining target markets/industries

- defining the target company profile (industry, size, location, ownership,

- creating a list of possible candidates and a structure for research and monitoring of those companies

- researching and evaluating transaction resources (brokers and/or investment bankers depending on the size of transactions)

- high-level due diligence (maybe, for instance, using data-based tools to measure the absolute capability of the target's sales team)

Management and the board need to agree on an appropriate reporting/information sharing structure, the reporting tempo, and the process for considering potential transactions. It will likely make sense to create a committee and/or working group if that structure doesn't already exist, and to clarify the task force's relationship to management and the board.

Sales Force Effectiveness Isn't Absolute - For You or Other Companies

What does sales force effectiveness really describe? It's a sales team's ability to win new deals. The same team will exhibit varying effectiveness based on market conditions.

That's why it's critical to use tools that will help you measure against absolute standards, vs. relative ones.

Regardless of the market environment, you need a sales team that is:

- staffed with the right number

- built on the right model (inbound sales, inside sales, partnerships, channel, etc.)

- with the right skills to win your kind of deals (size, sell cycle, target buyer, etc.)

- superior to competitors' teams

The current spate of layoffs creates some specific opportunities for you to improve all of those. The right tools will help you identify the right people to keep and/or to add as you pursue these opportunities.

1. https://www.wsj.com/articles/the-companies-conducting-layoffs-in-2023-heres-the-list-11673288386

2. https://www.businessinsider.com/layoffs-sweeping-the-us-these-are-the-companies-making-cuts-2023