It's the data....not the machine

I recently wrote an article entitled "Why are American Machinery Manufacturers Ignoring IoT & Industry 4.0?" I cited data from Boston Consulting Group that highlighted the rather relaxed approach US manufacturers were taking to the IoT.

I wrote about differences in perspective and mindset.

Companies tend to think of IoT in one of two different ways. It's either

machinery.....that has sensors that collect and send data

or

vehicles for data collection and optimization....which also perform industrial manufacturing functions.

That came to mind recently reading an article on PackWorld.com which chided industry for conflating terminology, noting that "Two terms often used interchangeably are 'Internet of Things (IoT)' and 'Industry 4.0.'" It then went on to clarify that:

"maybe (manufacturers) and their OEM suppliers should be more careful to distinguish between the two. It’s true that in a general sense, they occupy the same space in reference to the digitalization of the world. But...those similarities only exist at a distance...IoT is much more of an IT and cloud construct. Meanwhile Industry 4.0 is much more focused on the factory floor, how to optimize factory floor operations, and how to make machine communication more efficient."

That's precisely the problem. As long as machinery builders continue to view the factory floor as a collection of machines that is distinct from the cloud, they'll continue to miss the point.

It's not just a theoretical musing

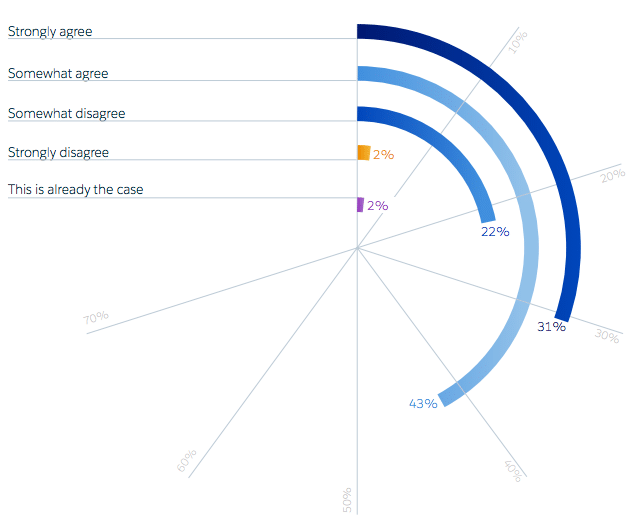

The 2016 Salesforce Connected Manufacturing Service Report looks from a different angle. When manufacturing executives were asked "How much do you agree or disagree with the following statement? Within the next ten years, I believe products will become “loss leaders” where services (e.g. data, maintenance, etc.) will be the primary revenue drivers for my company." the answers were sobering. 74% strongly or somewhat agree that products will become loss leaders within 10 years - services, like data, maintenance and product service recurring revenue models will be the drivers of profitability and growth.

This isn't a question of which features to include in your next version - this is a question of economic viability.

The problem is that most sales people and managers at industrial manufacturing and capital equipment companies are born and raised with product genes. They see the world through the lens of their product - many of the SMBs today have helped to create entire categories. So it's understandable that they're confident in their understanding of how machinery meets production requirements.

Data, data everywhere but it's mostly meaningless

Industrial manufacturing likes to talk about data - and they focus on daily production targets for their buyers. And they're falling behind.

Two decades ago manufacturers sold to their manufacturing buyers based on rates/minute or hour. Buyers started to get savvy to the issues of efficiency, and as OEE (operational equipment effectiveness) became popular, sellers started to talk in terms of net daily production.

That's where the better sellers focus now, but buyers are moving beyond that.

The new requirements, which buyers themselves haven't fully defined or envisioned (that makes it tough for suppliers, although it's not an excuse not to try!) are at the intersection of their Industry 4.0 capability and their customer requirements.

The September issue of Harvard Business Review has two relevant articles. In the first, Know Your Customers' "Jobs to Be Done", Clay Christensen and co-authors highlight the importance of empathetically understanding your buyers', and even their buyers' real objectives - not what you're conditioned through your manufacturing lens to believe is reasonably achievable. (The This is Product Management podcast has an interesting interview with Karen Dillon, co-creator of the framework.)

In the second, Building an Insights Engine, execs from Unilever set the context as follows:

Operational skill used to confer long-term advantage. If you had leaner manufacturing, made higher-quality products, or had superior distribution, you could outrun competitors. But today those capabilities are table stakes. The new source of competitive advantage is customer centricity: deeply understanding your customers’ needs and fulfilling them better than anyone else.

Where did Unilever find the data to fuel the insights necessary for this transformation? Through what they call their Consumer and Market Insights Group. That function, or role within most SMB manufacturing companies is immature. It's traditionally relied on explicit customer inquiries, rep requests, product manager interviews and management emphasis.

And yet today it's easier than ever for SMBs to accumulate data to fuel insights - and to do so on a modest budget. But only if they're willing to understand the expanded role of industrial marketing in the digital world which their prospects inhabit.

Industrial marketing data holds the key to success for SMB industrial manufacturers.

Circling back to the terminology

So some manufacturers will choose to focus on the jobs they can easily envision - incremental improvement in machine efficiency. Their "bosses" will make tough decisions as Ludwig von Mises describes:

The real bosses, in the capitalist system of market economy, are the consumers. They, by their buying and by their abstention from buying, decide who should own the capital and run the plants. They determine what should be produced and in what quantity and quality. Their attitudes result either in profit or in loss for the enterpriser. They make poor men rich and rich men poor. They are no easy bosses. They are full of whims and fancies, changeable and unpredictable. They do not care a whit for past merit. As soon as something is offered to them that they like better or that is cheaper, they desert their old purveyors. With them nothing counts more than their own satisfaction.

Others will use their vast digital prospect and customer interactions, in conjunction with a thoughtful and strategic array of thought leadership content, to develop the insights necessary.

And that could be key to more than just revenue growth.

Just as interpretation of data is the secret to understanding your buyers' jobs and to teasing insights that can give you a competitive edge, similarly data could become a significant strategic asset of your business.

When you begin to embrace the power of those insights that you tease from your accumulation of industrial marketing data, you'll not only sell more to buyers eager for your application of technology to make them more effective (vs. simply more efficient) but you'll create your own firm's IP around how to create repeatable and predictable growth.

So you can quibble about IoT vs. Industry 4.0 and struggle to locate and justify where your machinery, product or service fits in the spectrum as you understand it.

Or you can work to understand where your firm's expertise will make you particularly important in the spectrum which is evolving.

In that world the ability to talk among machines will be like the "table stakes" the HBR article references. The key to ongoing vitality will be the ability to help you buyers satisfy their buyers - whether it's in the cloud, on the factory floor or elsewhere that we haven't yet imagined.

While you're building that understanding, though, you've got to succeed today. That's why getting started with a strong industrial marketing program is important to build the capabilities and revenue growth necessary to support your bigger, future steps. This Guide to Manufacturing Revenue Growth maps it out for you step by step. Get your copy here.