Tl;dr - A strong board can be threatening to founders of family-owned industrial manufacturing businesses. But a board with independent directors can also be a powerful asset, particularly when facing market turmoil like a recession. Here's how to structure a private company board of directors for maximum benefit in market conditions like today's.

Stereotypical Private Company Board of Directors in a Middle Market Machinery Business

You can picture it. Friends and family, with few or no truly independent directors, mostly executive and non-executive employees, along with spouses, siblings, and maybe a familiar CPA, attorney and/or wealth advisor thrown in.

This is simultaneously a success and a catastrophic failure.

It's a success in that the board represents (or rather reflects) the shareholders who, in many closely-held, family-owned, industrial machinery companies, are family.

It's a failure in that the role of the board is to provide strategic oversight and management of the CEO. The familial relationships and familiarity, and the insular nature of a family board, are inimical to that obligation.

Often CEOs prefer this arrangement. It satisfies legal requirements of the board structure (annual meetings, etc.) but allows him/her to run without much oversight. Businesses become "lifestyle" focused, spinning off adequate income to reward years of brutally hard work and stomach-churning risks, and to provide sinecures to envious family members in an effort to reduce conflict.

But that's not a recipe for long-term success. The role of a private company board is to represent the interests of the shareholders collectively.

Companies that seek to optimize performance (revenue, enterprise valuation, and the infrequently measured but important return on equity) need a board with adequate independent director participation to provide substantive insights informed by commercial experience across situations. In fact, nothing dictates that a board include major shareholders.

While that may be desirable, when major shareholders have no experience beyond the idiosyncratic family business they often lack the skills needed to contribute to the board and simply revert to their personal priority financial interests.

Strategic Skills & Experience

An effective private company board of directors is comprised of a group that brings individual strengths and perspectives into a body with considerable aggregate business savvy and experience.

That means people who individually are experts in disciplines that are of strategic importance to the company, and collectively effective and complementary.

Let's take a company that builds machinery used in food manufacturing, for instance, and assume a board of 11 which includes eight independent directors (accounting for two executive members and an additional family member.)

Using a board of directors skills matrix it's possible to identify areas of expertise that the board should fill. These might well include:

- global business expansion (including tax, regulatory, sales, FCPA, transfer pricing, etc.)

- food safety and production regulations

- nutrition

- institutional food operations (restaurants, cafeterias, distribution, etc.)

- retail (grocery, consumer, distribution)

- M & A (every company should always be open to strategic opportunities for acquisition and sale - but with realistic expectations)

- business models (e.g. subscription services, recurring revenue)

- technology (e.g. 3D printing, IIoT)

- sales growth

- digital marketing

- tax, accounting, and finance

- ingredients and trends (e.g. clean label, sustainability, alternative protein)

- talent management (finding & retaining top talent, compensation, benefits)

- partnerships (e.g. sales channel if applicable, related technologies)

- machinery manufacturing

- and of course, food manufacturing

- generational and geographic perspective (to interpret trends, provide perspective during cycles, etc.)

You'll have some others yourself to add to the list.

That means that for directors and boards to have a credible perspective on these relevant topics that should shape strategy and management decisions, you'll have to pick directors very carefully to acquire skills in all.

Even with careful recruiting, you'll probably use outside consultants and advisors to bolster some, but it's important that these strategic areas are represented in all discussions.

Further, you need the group to collectively bring savvy and experience in routine board activities including CEO evaluation and succession, and strategy development and review.

But for any of this to work, the CEO and shareholders have to want a board that will challenge and help them achieve strategic objectives - and accept that they'll feel uncomfortable and may have to forgo positions of authority for which they're ill-suited.

It's a tall order. That's why it's rare.

When a board is properly assembled and operated it's also an asset in turbulent times - like market downturns. While a weak board will react (often late) with reflexive decisions like spending freezes, a strong board will be proactive, avoid overreaction and position the company for outsized gains as recovery takes hold.

Here's what strong private company boards should be discussing with the executive team today.

Private Company Board - Recession Prep

Effective boards follow the simple guidance of "nose in, fingers out." In other words, they know what's happening in the company, but they don't meddle. It's up to management to pull the levers.

But it's up to the board to make sure management is watching the important gauges, has the right plan in place to react, and has adequate resources to employ.

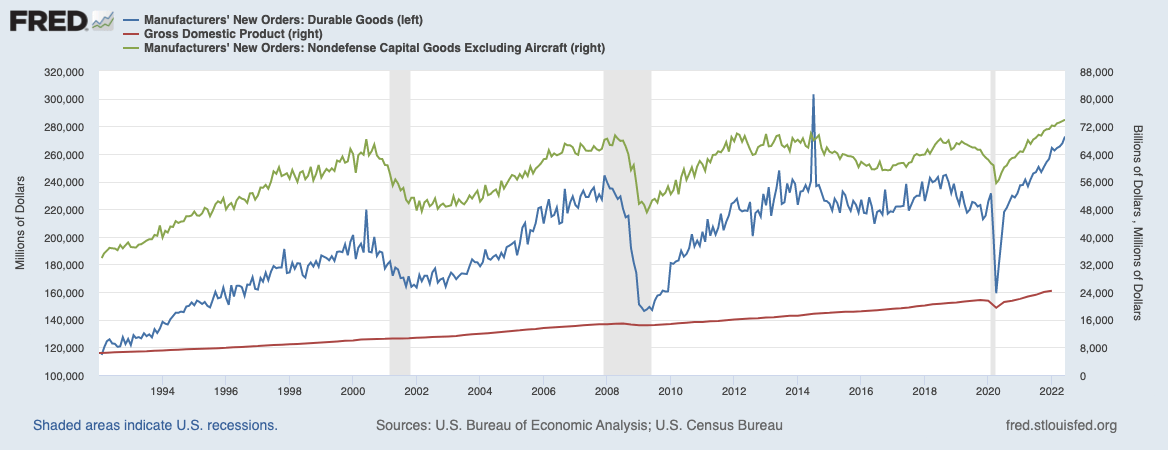

Take a recession for instance. We know that relatively minor recessions (1-2% negative growth) can have a catastrophic impact on revenue (30-50% drop in capital equipment and durable goods.)

Therefore, a board today should be concentrating on the following:

- predictive metrics - looking at historical ones (order bookings) delivers actionable insight too late

- sales team - is the team being coached for the upcoming game

- lead generation and marketing - are they focused on building competitive advantage and penetrating key accounts while others hunker down

- revenue growth process - for efficiency and predictability

- financial preparedness - solidifying commercial lending relationships and carefully monitoring covenants and ratios, vetting vendors, tightening credit guidelines

- how they can help - team selling

Let's look at each.

For a full overview of four important steps to take today to prepare for success during a recession, check out this 35-minute on-demand webinar.

Metrics

The board should be provided with a dashboard that includes predictive and diagnostic information including:

- lead generation, website traffic, lead conversion rates, cost/lead (CPL) by source

- lead funnel showing qualifications

- aggregate (able to drill down to rep level) value and change

- sell cycle

- activity level

- number of meetings

- qualified deals in pipeline

- cost of customer acquisition (CAC)

- pipeline funnel with details on deals advancing vs. not

- meetings/deals by industry, geography, product line, customers vs new logos

Note that many of these will be difficult to produce given the current state of technology in sales and marketing. That should be a red flag, and become a strategic initiative. Like an inability to close books monthly, the inability to provide accurate and consistent predictive data on revenue is irresponsible and reflects poor management.

Sales

The board should request:

- periodic briefs on the sales team (including managers and VPs), based not just on numbers but on empirical evaluations

- training plan and progress

- recruiting efforts (to backfill gaps and capture available talent)

- scenario planning for sales force reduction if required (based on data and science-driven analysis)

- market briefings from random reps and managers to insight into market feedback

- updates on evolution in sales process and methodology

- updates on sales model (e.g. experimenting with inside sales)

Marketing

A prepared board will expect:

- refinement of the ICP (ideal customer profile) and buying team/buying journey

- competitive briefs on discounting and key accounts (including "status quo" and the company's own products on the secondary market)

- identification of barriers (e.g. spending freeze) and plans for how to counter/overcome them

- resource allocation decisions to support lead generation

- detailed win/loss reports on key deals

Revenue Growth Process

If revenue is unpredictable, forecasts unreliable, and the process is primarily reactive to the market, management is not managing. The board needs to preempt that.

The key is to understand how all the components integrate and relate.

That's the premise of ORE™ and boards should consider using the ORE Diagnostic to get independent insight into the organization's maturity.

Financial Preparedness & Broad Strategy

Vendors will fail, bankers will get tense, shareholders will get anxious, and employees will get worried as they see layoff reports on the news.

The board needs to guide management in communicating clearly and honestly with stakeholders. Procurement should source secondary suppliers. Finance should investigate receivables insurance. Manufacturing should carefully monitor inventories.

At the same time, key talent could become available, as valuations fall acquisitions will become feasible, and competitive strongholds may become vulnerable. That board should keep management focused on the subsequent rebound as well as navigating the downturn.

Team Selling

As more "spending freeze" and project delay edicts are issued from corporate headquarters, sales reps will have less personal ability to influence sales.

Management, sales, and marketing all need to collaborate on messaging, tools, and approaches to offset and counter these trends, but also plan for how to overcome them with sales efforts.

The board may play an important role in team selling and their ability to reach certain key leaders and executives at target accounts to learn about prospects' and customers' planning. This will provide perspective for the board and management, and also create opportunities for sales discussion that could help advance deals.

Is Your Board an Asset?

It takes a strong CEO to want to be held accountable. To not just say it, but to embrace it even as it's happening and uncomfortable.

For a CEO with that self-assuredness, a strong and strategic board of independent directors can be enormously valuable. Diverse expertise will help to uncover and capture opportunities as well as avoid risks and mitigate downside impacts.

Achieving that requires a vision for the board's proper oversight (not rubberstamp) role, a deliberate and ongoing effort to construct the right board, and appropriate, respectful engagement and responsiveness between the board and management.

A recession is a perfect case study for how a proper board can help protect and then grow a company through market cycles.