Tl;dr - Most capital equipment companies seek to survive a recession. Some sidestep most of the pain. But few look across the trough to create amazing revenue growth opportunities. Here are ideas to help your company use a recession and economic recovery as an amazing springboard for growth.

Revenue Growth & Competitive Dominance After the Recession

We're likely going to have a recession.

We're likely going to have a recession.

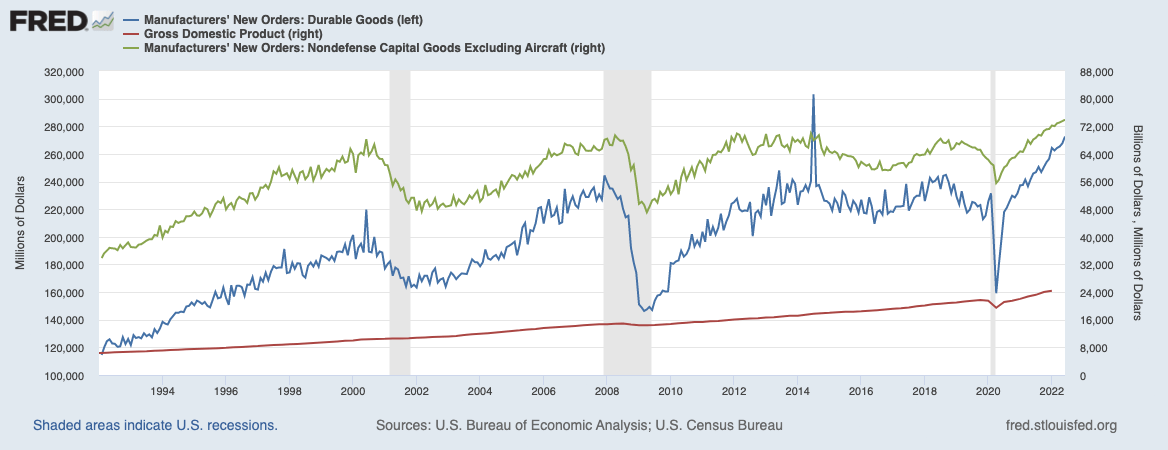

How soon (already?), how deep, how broad (all industries?) are all open questions, with many contradictory signals indicating conflicting scenarios. In fact, if you subscribe to any contrarian indicators, the pervasiveness of recession doom may be the strongest contra-indicator around.

At the very least there's enormous uncertainty. Social, political, supply chain and other factors are giving many executives and boards pause when considering the timing and magnitude of capital investment.

So the possibility of a recession, or upheaval, becomes self-fulfilling for capital equipment manufacturers.

That creates challenges and opportunities for companies with the management vision and strength to acknowledge them; a minority.

Most companies (average companies) continue to simply motor along, focused on delivering previously booked orders, vaguely aware that inquiries are slowing, close dates are slipping and the pipeline is becoming attenuated.

Strong companies have begun to prepare sales and marketing for a recession to minimize any dip in revenue and to proactively plan approaches that will resonate with their buyers in those circumstances.

Great companies are planning in another dimension. They recognize that a recession is likely impending. They've taken steps to prepare. And now they're planning how they'll accelerate quickly ahead of competitors when the market starts to turn.

Let's look at the planning and preparations that companies can take now to seize those opportunities, and ultimately help through the impact of revenue on economic growth.

Plotting Recession Impact on Capital Equipment Ecosystems

Let's think through the implications of a reduced economic growth on most capital equipment sales. The symptom that most think of is slowing sales. It's common for prospects to cancel, postpone, or simply slow-walk capital projects.

Let's think through the implications of a reduced economic growth on most capital equipment sales. The symptom that most think of is slowing sales. It's common for prospects to cancel, postpone, or simply slow-walk capital projects.

Projects that are in the pipeline may be killed or die slow deaths. New project planning and inquiries are less frequent. And it's more difficult to proactively create a project.

Those are the short-term consequences. A typical recession lasts 9 months, and we're often recovering before we start to feel relief. That's because of structural dynamics that have longer-term impacts.

Generally recession reactions include:

- Conserving cash (particularly given higher borrowing costs than many companies have planned for)

- Talent turnover

- Machinery liquidations

You'll have others on your list from your experience.

Let's look at how each of these will impact the market in different ways and at the revenue growth opportunities they may create if you're prepared.

Declines in Economic Growth Impact on Competitors

Your competitors will experience duress just like you used to...before you started to take proactive preparatory steps like those I cover in this on-demand webinar.

Cash - As cash tightens they'll slow payments to vendors and reduce inventory. That will impact spare parts availability. The hunger for cash will be reflected in discounts on new machines because their sales team will likely be unprepared to maintain margin in recession sales.

Talent - They'll likely have some layoffs. Generally, these will be newer, less-experienced members of the team. Early retirements, though, may impact some of the "brain trust" or the deeply experienced engineers, technicians, and assemblers of long tenure.

Used Machines - Many of their older machines will come on the market as customers close or are acquired, and machinery is liquidated.

Customer Adaptations to Recession

Cash

Customers will preserve cash like all companies. That will translate to reduced proactive purchase of parts and service, and slower payments. Machine upgrades, replacements, and additions will often be put on hold, although rebuilds may be more appealing. Prepare your team for the fact that buyers will be told to ask for and expect more discounts. Practice the sales skills to resist this.

Here's a pro tip. Many companies have gotten cavalier about rigorous credit checks and managing AR. Cash has been cheap enough that carrying receivables hasn't been burdensome, and there have been few defaults. That will change as cash tightens for customers. Consider inexpensive receivables insurance options. I'm happy to provide a referral if that's of interest. The devil is indeed in the details of these policies and you need a knowledgeable guide.

Talent

As customers reduce staff, often in-house experience with parts and maintenance will deteriorate. Your support team will have to start from scratch with some new folks. Also, engineering and maintenance teams may be reduced, and that will be reflected in the deteriorating performance of equipment and a lack of engineering resources to evaluate projects later. At the same time wage growth will slow, so the budgets and needs for automation will be diminished.

Used Machines

Often used machines become your greatest competitor with current customers whose familiarity with your machines makes them more comfortable with acquiring inexpensive but relatively strong machines on the market and rebuilding them in-house. Tax reforms may be introduced to incentivize capital investment, but corporate taxes are irrelevant if companies aren't solidly profitable.

Prospect Recession Experience

Prospects will experience a recession much like customers, although of course, they'll primarily interact with the competitor with whom they have an existing relationship.

Economic Recovery Capital Equipment Game Plan

It's important to note that this plan assumes you're more resilient than competitors, having proactively prepared. If you're hanging on just like them, there's not a lot of opportunity here.

Assuming you were prepared, though, with proactive investment in and improvement of strategy, digital marketing, industrial sales and technology, then you'll have a target-rich environment as economic growth returns.

Here are areas to consider for specific action and campaigns.

Manage the used machine market

Used machines will be a large competitor, but also a potential asset. Create alerts and routine scans of common auction sites to identify your brand (and perhaps competitors) coming on the market. Buying those machines will take some cash, but will provide various opportunities. These include:

- Eliminate/reduce the difficult competitive threat of "the same machine" for less

- Secure frames and key components for complete rebuilds, and lightly-used machines for refurbishment

- These rebuilt/refurbished machines will likely represent a much lower cost than new machines, so even sold at a reduced price they'll be profitable. This allows you to provide a "discount" when it's really necessary, without impairing profitability

- An inventory of machines, particularly if rebuilt to a neutral point or for the most common applications, provides opportunities for rapid reaction as companies start to ramp back up. You can win deals with loaners/rentals while new machines are being built

- This fleet of machines also provides the foundation you need to begin feasibly exploring recurring revenue models. Servitization or Product as a Service (PaaS) recurring revenue models.

Target weakened competitors

Each competitor will weather the recession differently. Some will be in desperate straights. Others may flourish. And many will experience duress.

If lack of cash and loss of talent result in serious degradation of support, this can create an important opportunity for marketing and sales knockout campaigns. Of course, any effort targeting weakened campaigns needs to focus on the buyer's business experience rather than the competitor's direct weakness. While it's an opportunistic play, if your real motivation is something other than helping the buyers, it will boomerang. Remember that they decided to buy from the competitor. In retrospect, that was a flawed decision, but if you gloat, you'll fail.

If lack of cash and loss of talent result in serious degradation of support, this can create an important opportunity for marketing and sales knockout campaigns. Of course, any effort targeting weakened campaigns needs to focus on the buyer's business experience rather than the competitor's direct weakness. While it's an opportunistic play, if your real motivation is something other than helping the buyers, it will boomerang. Remember that they decided to buy from the competitor. In retrospect, that was a flawed decision, but if you gloat, you'll fail.

You also may find opportunities for low-cost acquisitions. Consider a range of opportunities including direct competitors, after-market parts suppliers in your industry, significant independent distribution channels, and possibly even line extensions into other related machinery and operating consumables and software. These acquisitions can provide an immediate accretive impact on earnings, but also support longer-term strategic goals. (This is an example of the value that strong independent directors and a robust board can bring to your company.)

Recruit key talent

Make a list of the skills and even names that you'd love to add to your team. It wears on a team to wonder every Monday and Friday if that will be the pink slip day, and as factories grow silent, the angst increases. Often key designers and engineers will take intense personal offense at being told to limit support for customers. They may welcome a philosophically refreshing buyer orientation and bring with them particular know-how and expertise.

This can also be a perfect time to recruit talent to add products and services without an acquisition. For instance, a consulting engineer that performs performance audits but isn't great at sales (and therefore struggling) or a rep who's built a good book of business selling related consumables could both welcome employee benefits and a secure environment to do what they love without the other worries.

This can also be a perfect time to recruit talent to add products and services without an acquisition. For instance, a consulting engineer that performs performance audits but isn't great at sales (and therefore struggling) or a rep who's built a good book of business selling related consumables could both welcome employee benefits and a secure environment to do what they love without the other worries.

But a caveat! Be very careful about recruiting sales. If a sales rep finds themselves released from a company that continues to operate, it's likely that they were underperforming. Sure, given different training and circumstances maybe they'd succeed. But competitive reps don't normally bring the business you expect and you don't need any "projects."

However, strong reps will often grow disgusted with a company's inability to deliver what they're selling, and other companies will fail outright. This can be a rich source of superb sales talent. So start today by launching a continuous recruiting initiative. Be sure to use candidate assessments for every candidate at the very beginning of the process so you're not seduced by years in the industry or other largely irrelevant factors.

Create programs to solve for buyers' staffing

Maintenance and engineering are already bottlenecks in many companies. New projects are limited by engineering resources and production efficiency is impaired by reduced maintenance.

Recognizing this lets you proactively and creatively solve for their problems. Maintenance and training agreements, automatic shipments of wear items, access to consolidated customer portals and knowledge bases, and automated interval maintenance reminders are examples.

Recognizing this lets you proactively and creatively solve for their problems. Maintenance and training agreements, automatic shipments of wear items, access to consolidated customer portals and knowledge bases, and automated interval maintenance reminders are examples.

You could also use the acquisition and recruiting options above to add talent or departments to provide engineering services. (Be thoughtful about branding and positioning. Buyers will be understandably skeptical of captive services which they assume will only recommend your own products.)

Companies ramping back up but still hesitant to make large capital investments might value a fleet of machines that can be quickly installed as rentals or PaaS solutions.

And programs to help your customers create more value for their buyers (e.g. technology to provide consumer access to details of organic providence) or their own operations (technology to monitor and boost OEE) could be valued.

Recession and Economic Recovery Mindset

Most lower middle market machinery companies dread a recession, and simply hunker down and try to survive.

Most lower middle market machinery companies dread a recession, and simply hunker down and try to survive.

With appropriate preparation, they should be able to forestall significant revenue declines.

But with strategic vision, companies can leverage recessions to create important revenue growth opportunities and quickly accelerate past competitors.

The economic recovery which inevitably follows a recession, often spurred by government spending and changes in tax policies, is an opportunity for you to position your business for important and meaningful revenue growth and market share increase.

Some Thoughts on Navigating A Recession and the Impact of Tax System Changes

As we delve deeper into the realm of economic recovery and revenue growth, it's essential to understand the pivotal role that the tax system plays in shaping the business landscape. Tax policy has a profound impact on the financial health of businesses, individual taxpayers, and, by extension, the overall economic growth of a nation. Although not something a business owner can control, it's still important to consider the implications. So let's take a high level look at the intricacies of the tax system, discuss the effects of various tax policies, and analyze empirical evidence to shed light on the dynamic relationship between taxes and economic prosperity.

And keep in mind that your employees will each experience a downturn in their own way, and will have anxiety regarding the company's financial health.

Tax Policy and Economic Growth

The tax system, comprising various elements such as personal income tax rates, marginal tax rates, and tax code intricacies, plays a pivotal role in shaping the economic environment in which businesses operate. Governments utilize tax policy as a tool to raise revenue, redistribute wealth, and incentivize or disincentivize certain behaviors. The decisions made regarding tax rates and regulations can have far-reaching consequences, particularly during times of economic downturn and then recovery.

Tax Changes and Their Impact on Revenue

One of the most hotly debated topics in economic research and political discourse is the impact of tax changes on government revenues and overall economic growth. Tax cuts, in particular, have been a subject of intense scrutiny and discussion. Advocates argue that reducing tax rates can stimulate economic activity, leading to increased business investment, job creation, and ultimately, higher tax revenues. Conversely, opponents of tax cuts express concerns that lower tax rates could lead to lower tax revenues, potentially exacerbating budget deficits. They often question the feasibility of the so-called "trickle-down" effect, where benefits from tax cuts for businesses and high-income individuals are expected to filter down to the broader population.

Empirical Evidence and Tax Proposals

Empirical evidence on the relationship between tax policy and economic growth is mixed, and the impact of tax changes can vary depending on the specific circumstances. Numerous studies have attempted to analyze the effects of tax cuts on economic growth, but the results are often influenced by factors such as the timing of tax changes, the state of the economy, and the overall tax code complexity. It's crucial for policymakers to base their decisions on sound economic research and data-driven analysis when considering tax proposals. A well-structured tax policy can strike a delicate balance between raising necessary government revenues and promoting economic growth.

Government Revenues and Fiscal Responsibility

While the focus of tax policy is often on promoting economic growth, it's equally important to ensure that government revenues are sufficient to meet essential public needs and maintain fiscal responsibility. The federal government relies on tax revenues to fund critical programs and services, ranging from infrastructure development to healthcare and education. Changes in tax rates and tax code adjustments can significantly impact government revenues. It's essential to assess the potential consequences of tax policy changes on government finances to ensure the sustainability of public services and investments in the long term.

Wage Growth and Economic Prosperity

Another critical aspect of tax policy is its influence on wage growth. A well-structured tax system can provide incentives for businesses to invest in their workforce and offer competitive salaries. Higher wages, in turn, stimulate consumer spending, which is a fundamental driver of economic growth. Conversely, if tax policy discourages business investment or leads to stagnant wage growth, it can hinder economic prosperity and limit opportunities for individuals and families to improve their financial well-being.

Conclusion: A Balancing Act

Tax policy is a delicate balancing act that requires thoughtful consideration of various factors, including government revenues, economic growth, and individual financial well-being. While tax cuts and changes can potentially stimulate economic activity, the impact varies depending on the specific context. Policymakers must rely on empirical evidence and economic research to inform their decisions, aiming to strike a balance between fostering economic growth and ensuring fiscal responsibility.

The tax system is a powerful tool that, when wielded wisely, can contribute to a thriving business environment and overall prosperity for a nation. As businesses navigate the complexities of economic recovery, understanding the intricacies of the tax system and advocating for sound tax policies becomes increasingly vital.

By doing so, we can create an environment where businesses can thrive, individuals can prosper, and the nation can achieve sustainable economic growth.