Competition rises as demand falls

What happens when trends are mutually reinforcing?

Three items this week all seemed to line up around the challenges and opportunity for industrial manufacturers.

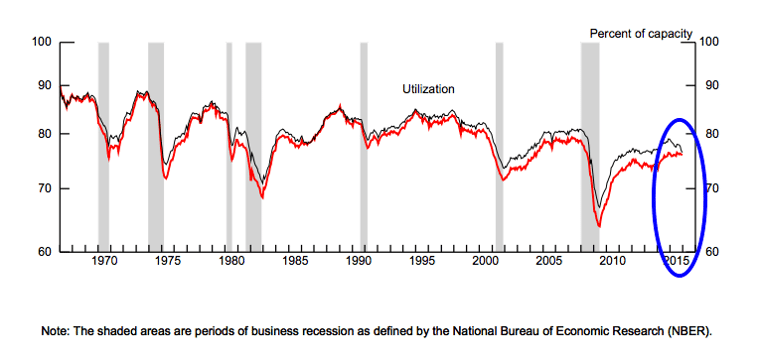

Economic environment

First, (and quickly) from the finance world. John Mauldin recently featured Lacy Hunt in his Outside the Box article. (follow @JohnFMauldin) Industrial production has stalled and utilization is falling. That's aggravated by the fact that monetary policy has provided implicit insurance against risk in financial assets without corresponding insurance for investment in capital equipment and manufacturing. The misallocation of resources that's developed over the last several years likely can't be quickly or painlessly corrected - especially as the yield curve flattens and the dollar strengthens.

State of Industrial Marketing

Second, a recent report from IHS Engineering360 Media Solutions provided survey insight into the state of industrial marketing. (follow @Engineering_360) Key observations (including some contradictions) from participating industrial marketers include:

- Only 12% can show how their content marketing contributes to sales - yet that's the benchmark 57% cite for how their marketing efforts are measured

- 39% are just getting started with content for their industrial marketing

- 42% are increasing their budget for online marketing, and on average they spend 41% of marketing dollars on digital initiatives

- 51% are increasing their spending on content marketing

- 43% say their biggest 2016 goal is customer acquisition. 21% say lead gen. Clearly content marketing needs to graduate from the chitter chatter to the pitter patter phase by delivering attributable revenue & profits

- Only 25% are at least "satisfied" with their company's online marketing efforts

- "Content Creation" is the single category of 23 for which companies plan to increase spending in 2016

The report makes several recommendations:

- Distribution & promotion of content is important - not just content creation

- Increased spending on content marketing may not deliver results (after all only 12% can even correlate the spend to success)

- At very least companies need editorial calendars and content created for each stage of the industrial buying cycle (3D buying journey)

- Companies shouldn't assume that working through these challenges alone is likely to succeed - consider hiring advisors (one of my favorites....)

- The biggest challenges include increased competition (there's lots of content out there now!) and an insufficient number of high quality leads

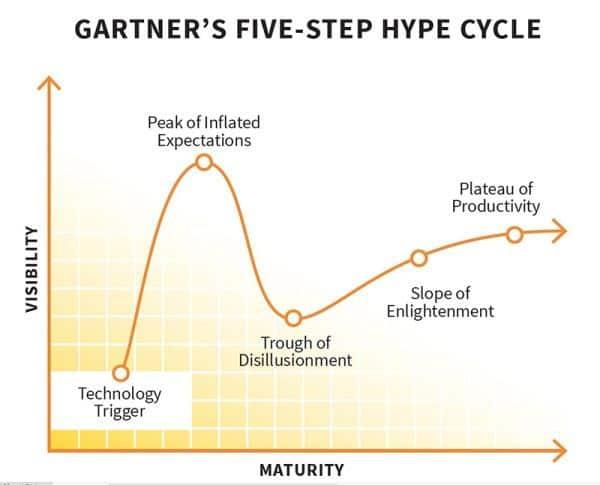

The content marketing hype cycle

Joe Pulizzi suggests that content marketing is "going to get weird." (follow @JoePulizzi)

He's right. Many mediocre industrial marketers have chased content marketing as the trend neared the peak of inflated expectations. With only 12% seeing actual sales result, and with the exhausting grind of continuous high quality content creation wearing on them, disillusionment is growing.

Converging trends that will make industrial marketing success rare

These three trends are converging. In short:

- Domestic demand for manufactured products is falling as a strong dollar makes exporting tougher and simultaneously makes imports cheaper. Competition is rising for the pool of orders which are being placed

- Industrial marketers are spastically chasing content marketing as the solution du jour, but it's really tough to execute and they're failing to produce material results

- The honeymoon with content marketing is nearly over. There's going to be an overshoot in the other direction as companies abandon content marketing in favor of...who knows where they'll throw their money. In the event of an economic slowdown most will simply slash marketing anyway.

But at the same time buyer behaviors continue to evolve at an accelerating rate toward self service research and education using the internet.

So the content model for industrial marketing isn't wrong - it's spot on. The execution however, as revealed by IHS, is flawed and the disappointing results will cause companies to abandon the effort as Pulizzi suggests.

The solution is to do it really, really well

Things are going to get ugly. Maybe in a month; maybe a year or more. But when they do, some companies are going to leapfrog ahead in their industries. As competition intensifies, those that can most effectively sell as buyers buy will succeed. And that same approach that makes them successful during a downturn will empower greater success as the ensuing recovery takes hold.

That means relentless, superb execution. And that's a tough hurdle to clear. Doing "content marketing" won't be enough.

Many companies will wither. Many agencies will as well. There will be lots of criticism of content marketing.

And there will be the best opportunity for companies to leverage the tool since content marketing started to get traction several years ago.

And how about your company? What's your plan? Victor or victim?

images - FederalReserve 15 Jan, 16 - Industrial Production & Capacity Utilization & ContentMarketingInstitute