Denial in Manufacturingville

I recently attended a webinar presented by IndustryWeek and Sierra Wireless entitled "Connected Strategies: Predictive Maintenance and Equipment-as-a-Service Opportunities". (You can watch it on demand here.) It brought together consulting (PWC) and industry (Sierra) experts to explore how IIoT is changing industrial manufacturing and operations.

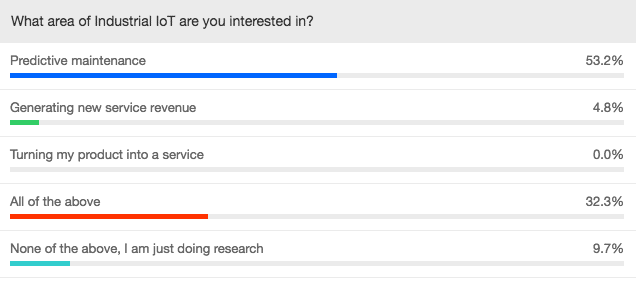

Early in the webinar they took a "temperature" poll to understand among the audience what the motivations were for their interest in IIoT. Here are the stunning results. More than two thirds (probably higher since nobody selected the topic separately and therefore the "all of the above" probably includes some bundling the other two choices) have NO INTEREST in how to turn their product into a service.

That's a capital equipment sales blind spot which I predict will cost companies substantially as their B2B buyers bring consumer preferences and expectations, and those from other B2B areas, to capital equipment procurement. This is why boards need to get involved in setting and monitoring strategy setting and execution for companies - digital transformation is here and many companies are ill prepared.

Silliness in Marketingville

Meanwhile marketers have decided they should wander afield from their LA & NY headquarters and check what real buyers, in most of the country where they make stuff, actually think. Does that merit a gold star? Here are interesting stories on shopping experimentation in Columbus, OH and a story from earlier this year on "cultural immersion trips."

Don't be too quick to dismiss these as simply B2C examples. Experience tells me that many industrial companies invest in marketing without solid personas to really understand how their buyers think. Some have one page "profiles" which are glibly assembled from the sales team's input and marketing's assumptions. And both are faulty sources - particularly for complex capital equipment sales. Real persona research is qualitative and undertaken by an outsider who neither creates hesitance among those being interviewed nor brings biases of what's "known." Adelle Revella covers this well in her book Buyer Personas: How to Gain Insight into your Customer's Expectations, Align your Marketing Strategies, and Win More Business and on her website.

The missed misalignment opportunity

The chitter chatter continues...does marketing throw too many junk leads at sales, or is sales inept at closing the great leads marketing sends it?

In my experience both....but this is a red herring.

The issue isn't misalignment between marketing and sales, it's misalignment between a company's revenue growth effort and it's prospects' desires.

Prospects and customers derive no value from the vestigial organizational units of PR, marketing, sales & customer service. Those are convenient and familiar structures for companies - and the source of friction for buyers. Low consideration sales can muscle through this since sell cycles are short. In complex sales environments like capital equipment sales, however, it's leading to dysfunction.

When you submit a chat request do you care who answers - beyond someone that can efficiently answer your question? When you need a budgetary price do you care which department prepares it as long as it's accurate to within your planning margin? When you're trying to dig deeper to understand solutions to your business challenges, do you care what title is on the business card of the person who most effectively intuits the information you need and gets it to you at the right time in the right format?

It's time to update the "alignment" conversation and move beyond internal turf battles.

Sales channel vs. buying channel

"Disintermediation" means that everyone's going to buy direct, right? After all the internet removes the requirement for a middle man to foster local relationships and provide access to information; just as advanced logistics remove the requirement for local warehousing.

"Disintermediation" means that everyone's going to buy direct, right? After all the internet removes the requirement for a middle man to foster local relationships and provide access to information; just as advanced logistics remove the requirement for local warehousing.

Manufacturers wrestle with the declining value of reps and distributors in capital equipment sales distribution chains.

But is that the real problem? If Grainger (a massive "middle man") plans to sell 80% of its products via ecommerce and Amazon is aggressively ramping up its B2B business, then are the middle men fading or becoming more important?

It turns out that just like the legacy distinctions between marketing and sales are disruptive to buyers, the traditional understanding of sales channel roles is constricting sellers' view of the change.

The entity that delivers what buyers want - in simplicity, CX, price, speed, educational information - wins. WalMart recently found that "makes my life easier" surpassed every day low prices as a driver of online sales.

This means that nobody owns the buying channel by virtue of their spot in the supply chain. The corollary should simultaneously terrify manufacturers and inspire every single rep agency - whomever delivers for buyers will win the business.

Large companies will have an edge with large-scale integrated ecommerce systems for low consideration sales. But in complex sales, the space is wide open - everyone has the same opportunity to establish that leadership, and brand and budget are increasingly irrelevant as the internet both allows buyers to manage every purchase as a unique event and sellers to establish a position limited only by their insights.

The key will be to really understand buyers rather than simply regurgitating the assumptions and biases that marketing and sales teams have long held. That's a far more challenging task than implementing technology - change is hard and behavioral/attitudinal change is brutally hard!

Navigating the turns ahead

If you're responsible for capital equipment sales or other complex industrial sales, these are examples of the issues you need to be thinking about and managing.

Want a roadmap? This guide outlines issues and provides sample questions to steer your planning and facilitate conversations with the strategic stakeholders in your company. Grab your copy here.