Buyers Blame You

In 2013, 67% of buyers blamed themselves and their own internal processes for the complexity and disruption involved in the purchase of new B2B technology, according to an annual IT buyer experience study by research firm IDC.

But in 2017, 61% placed the blame for this outcome squarely on information technology vendors. “Their expectations have changed,” Puthussery said. Warc

STOP!

Re-read that.

Buyers blame you for their struggles in buying. In four years they've shifted their mindset.

The article goes on to say that Cisco is "transforming its digital strategy to reflect the dramatic shifts that are reshaping B2B marketing," and further to explain that the shifts in buyer expectations have led them to think bigger. They're moving from thinking of digital marketing, to "marketing in a digital world – a world that’s transformed because of digital technologies."

You may find solace in the fact that you're not Cisco. Because you don't have their resources, you'll give your business a mulligan.

That's the wrong move. Buyers don't care. In fact the middle market may be most in jeopardy between resource rich enterprise competitors, and nimble, hungry, disruptive startups.

Buying teams

While technology changes expectations of digitally adept buyers, organizational changes are disrupting traditional sales processes.

The "decision maker" is about as pertinent to success today as the fax machine. They're both vestigial threads from a different B2B era.

Today buying is done by committee and consensus. There's still a putative decision maker of course, identified as the person that could sign the check or shift the budget. While they have that authority they rarely use it. Instead companies plod, as managers (by definition these aren't leaders) defer decisions to groups. Groups in turn are easily disrupted by one or two dissenters who, whether motivated by legitimate concerns, departmental bias or petty personal preference, can stymie progress.

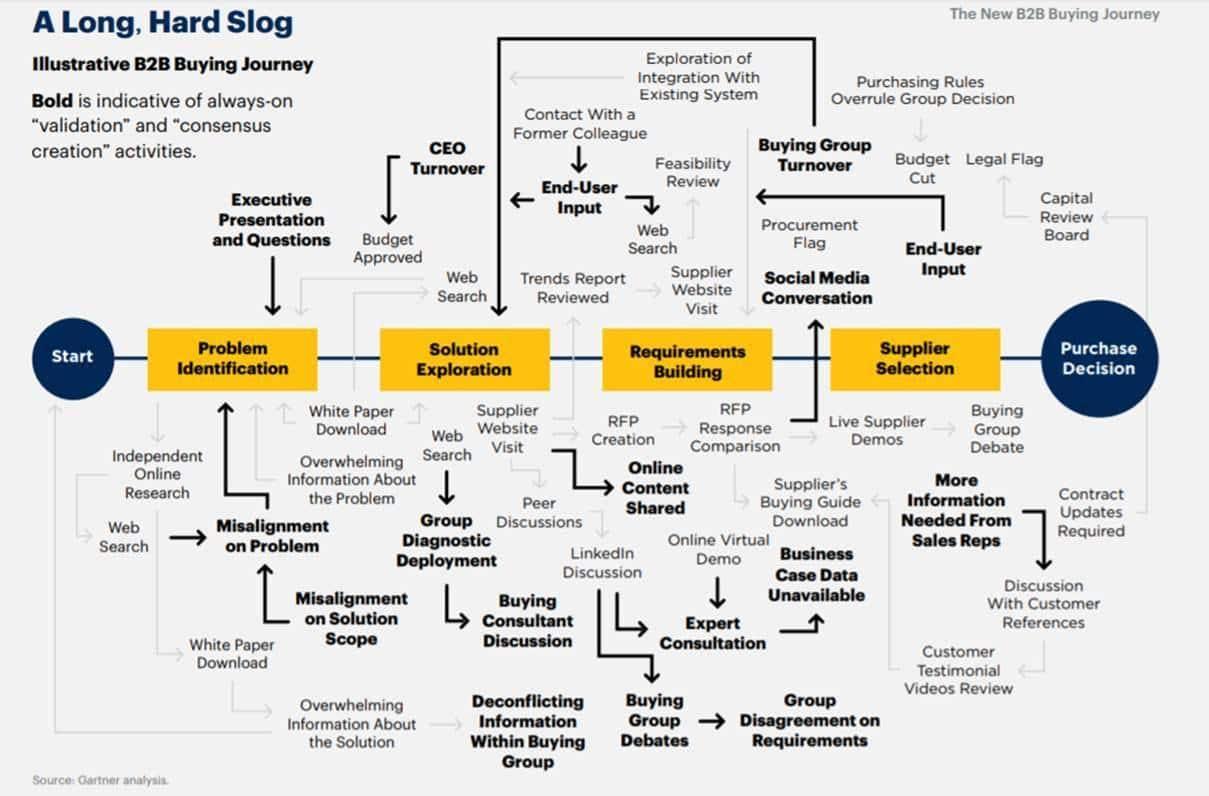

It's a challenge in theory, but in practice it's daunting. Bob Apollo recently shared this graphic from Gartner which illustrates in agonizing detail the convoluted team buying process of what they call "The New B2B Buying Journey."

It makes one wonder how any complex sale is actually consummated!

Understand the symptoms

Most companies will have heard of these various detours and distractions anecdotally. I've never seen it so completely illustrated however, and rarely are pot holes and speedbumps plotted to create a full picture. So within many companies there's general awareness of the growth of buying teams, but not full organizational response.

CEB's research illustrates the growth. From 5.4 buyers on average in 2014, buying teams exploded by 26% to 6.8 buyers on average in 2018. That means more agendas, silos, preferences, communications misunderstandings, and jam packed schedules. I believe the resulting complexity factor is logarithmic rather than linear- so it's substantially more than a 26% increase in complexity. And we haven't yet seen the 2018 numbers!

Because it's not documented, companies might not fully appreciate the challenge they face. But they're certainly well aware of the symptoms:

- longer sales cycles

- distorted pipelines often bulging at the quote stage

- more deals lost to "no decision" or the status quo

- unreliable forecasting

- convoluted and contradictory deal post mortems (please tell me you're actually doing these!)

These issues that you're almost certainly experiencing are symptoms of the increase in complex sales complexity that is attributable largely to growing buying teams.

This has implications to your sales process, sales methodology, martech stack, sales enablement content, digital footprint, and even to your sales force itself.

You probably have some sales people with long and illustrious track records selling to decision makers. They're probably struggling now; growing frustrated and blaming your price or lead-time. They're probably not going to able to change, and because of their past success they may be particularly resistant to coaching. That's an internal challenge.

While you manage the people, here are a couple easily implemented steps that can help.

Support your deal champion

During recent qualitative interviews to dissect the buying journey of plant engineers for an industrial client, I stumbled across a gem.

"The best companies I’ve worked with do the best job by helping the engineer be the salesman."

This makes sense, but it's rarely articulated and poorly understood. After all we've trained our sales reps to find "the decision maker", sell them, and let the rest sort itself out.

The deal champion has a vested interest in a successful project just like your sales person. In this case a plant engineer, the title can vary in industrial sales and might include maintenance manager, corporate engineer, plant manager and others. Regardless of title, that shared interest means that you both need to convince their multi-disciplinary buying team colleagues.

HR, finance, controls engineering, safety, quality, and IT will be part of many industrial capital equipment buying decisions. Each will have their personal quirks, departmental biases and functional preferences.

Look at all the bold "consensus creation" activities in the graphic...and then think about your data sheets and enablement content.

See the problem?

Most companies build their messaging around a single, amalgamated, "value proposition" which boasts of benefits tied to carefully engineered features. These often emphasize what the company considers important, only tangentially address the real outcomes that drive investment, and completely overlook the divergent perspectives of the buying team members.

In other words, what are you doing to help your deal champion "sell" their colleagues as your proxy? The common answer is "very little." That means that not only are you hampering your success - they won't be able to sell as effectively as you - but you're also missing the opportunity to differentiate yourself as a supplier. Do you really mean to be hard to work with?

Leverage Buyer Intent Data

One of the hardest aspects of selling to rapidly growing buying teams is the opacity of the organization and perspectives. Sales people are typically beholden to what the deal champion actually knows or is willing to share, or what they're able to elicit with artful questions.

As a result they don't know everyone who's involved by name, title or role. Nor do they know which competitors are in play, or all the key issues being considered.

Your sales people are flying blind.

No wonder it's so hard to navigate the process. You wouldn't wire your panels without plans and drawings connecting the dots.

Should you ask them to sell blind?

Many companies do, because they don't realize there's an alternative.

There is. Real Buyer Intent Data. (Note - don't fall for IP based FAUX buyer intent data. You'll need the key insight of real contacts.)

Buyer intent data will reveal critical insights to support the convoluted complex sales process for these growing buying teams. Insights include:

- what actions known participants are taking

- reveal additional participants on the buying team that you didn't realize were active - including contact details and job title

- discover others that may not be formal members of the buying team, but pursuing their agendas in parallel to influence the process

- what terms/topics they're taking action on (where they are in the buying journey, what considerations are driving the analysis, etc.)

- which competitors they're taking action with

- how different participants are pursuing different agendas (found at the intersection of their job title and the terms/competitors they're individually taking action with)

It's not quite like being in their staff meetings, but it's as close as you can get otherwise!