Intent Data Confusion

One of the interesting indicators of the rapid evolution of the intent data space is the pervasive confusion of definitions and criteria. While there's no authoritative body to adjudicate competing claims in the Martech space, over time "the market" does so, and a common understanding and lexicon often develop. Intent data is still early enough in development and adoption that even recognized B2B marketing leaders haven't coalesced around consensus definitions.

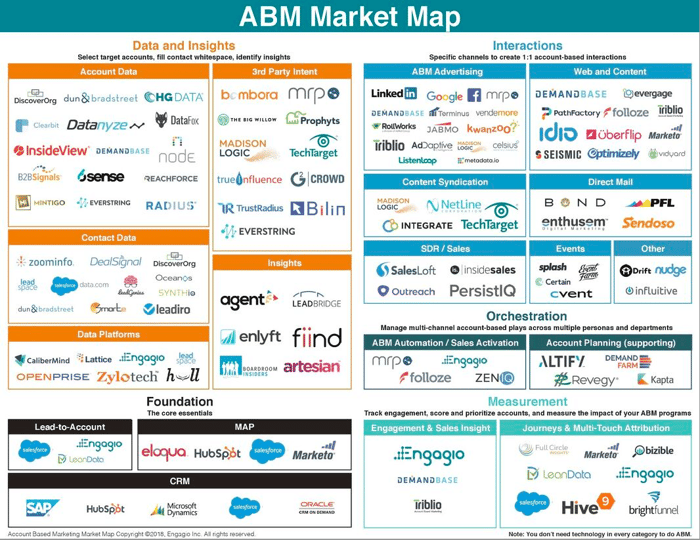

Engagio's account-based marketing (ABM) map (an analog to Scott Brinker's well known MarTech map) provides an interesting example. Produced by ABM platform Engagio, it categorizes account data (e.g. contact databases), contact data, data platforms, 3rd party data and insights.

I'd guess that tools which rely on predictive algorithms and some AI in the "Account Data" and "Contact Data" sections would probably object to being lumped in with static (even if robust) databases.

Similarly, tools which have invested in massive publishing platforms and domain authority, and which sell leads based on actions observed on their own platforms, would probably protest being lumped in the "3rd Party Intent" section.

So while we'll save the discussion of where intent data fits into the ABM universe for another day (You can learn more about various types and use cases here,) let's clarify the difference between 1st, 2nd, and 3rd party intent data. And then we'll look at a new and better option that delivers the best of 2nd and 3rd party models combined in a single model.

1st Party Intent Data

You're probably already harvesting this. If you're tracking visitor behaviors on your site, document interactions, email opens and clicks, and direct social media engagement with your own profiles, then you're accumulating 1st party (your own) intent data.

Just because you're collecting it, of course, doesn't mean that it's being fully leverage. Do your sales people receive behavior alerts (high intent page visits, proposal opens, etc?) Do you segment and manage your drip campaigns based on engagement? Do your conversational marketing playbooks dynamically adapt to observed behaviors? Do you limit email send to disengaged recipients? Are your sales people alerted if a current customer or prospect interacts with a relevant hashtag or competitor / competitor's employee handle? Do your sales people even review recent behaviors before calling/emailing a contact?

Those are common use cases for 1st party intent data.

2nd Party Intent Data

You're probably familiar with 2nd party intent data in the context of publishing and community sites which sell leads. Tech Target is a well known example with 140 some odd IT publishing sites which provide authoritative information to, and opt-in engagement with, tech buyers. They accumulate insights into who's reading what, who's comparing what, etc. It's Tech Target's 1st party intent data, but they monetize it through lead programs which they sell to tech vendors - for whom the information is now 2nd party intent data.

In the B2B industrial space companies often invest in trade show intent information (e.g. which attendees indicated they're interested in which type of solution) and some lead generation programs through associations and established trade journals.

In other words, 2nd party intent data is like your own 1st party data, but you're acquiring it from another group who has permission to share/sell it. You get the contact details and the information on the behavior, action, intent signals, but they own the relationship.

2nd party intent data is very powerful; and it's expensive. BUT, it's limited. By its nature it's constrained by the content that's available for engagement (how large their site is, or how broad/deep their analytics are.) Other industries and disciplines often don't have robust solutions like Tech Target.

Further, it is inherently limited to the vendors properties (or those they have arrangements with.) That leaves millions of other websites, content sources and important signal sources uncovered. If you're only selling enterprise software to a few hundred companies that will certainly use a couple platforms...that may be OK.

Or maybe not.....

3rd Party Intent Data

The concept of 3rd party intent data is to harvest insights from all the other interactions across millions of websites, social profiles, online communities, etc.

It's a great idea, and companies like Bombora (included on the Engagio map) have done a great job building awareness of the potential power of knowing that some person in an account is taking some action that indicates intent.

But here's where it gets tricky. You don't typically know who!

While you know the actual person with 1st and 2nd party intent data, that's not generally possible with 3rd party data. (Some providers offer cookie arrangements which will provide contact level information on visitors who have also been on your site - and a cookie set - but in a world where only 3% of potential buyers are active at any given time, that's not much help.)

Most of the time what you receive with 3rd party intent data is a list of anonymous contact actions which are observed by IP address. Vendors know that anonymous activity is of limited value, however, so in a sleight of hand they append (or overlay - you pick your euphemism) contact details, separately sourced, which meet your ideal buyer profile. That's not necessarily the person that took the action - but it's probably the one you'd be excited to connect with! You might call it a mirage.

From an ABM perspective, it can be helpful to know that some person from a target company took action that might indicate there's a project - but it doesn't help to focus or personalize the marketing or sales outreach. ABM ad platforms will gladly help you to bombard the target level of buyer at those companies with plenty of ads, but they'll be anonymous, and likely mistargeted.

A Bigger, Better, Richer Intent Data Option

This is where it gets interesting.

Imagine the scope of 3rd party data - the entire digital universe outside of your own properties - and the detailed contact insight of 2nd party data - with actual contact details of the leads!

That's indeed possible, and legal (all publicly available information) and precisely what Sales Fracking™ Intent Data does.

No longer must you choose between information that's actionable for personalization and sales, but limited in scope, or information broad in scope but anonymous and of limited use.

This means that your marketing can be segmented by individual attributes (stage in buying journey, competitor interactions, problem someone is trying to solve) in addition to the firmagraphic attributes normally associated with ABM. Further, it creates a bridge for the marketing to sales handoff, not to mention octane booster for your SDR or BDR outbound prospectors.

Want to learn more? Let's chat.