Tl;dr - There's a growing awareness and unease that marketing and sales teams may not be able to deliver continued growth as expected. That's complicated in manufacturing companies because managers, leaders, and board directors often have no formal or contemporary experience in those disciplines. The good news is that process engineering can improve revenue just as it did manufacturing and operations.

Data Points Tell an Important Story on Corporate Growth Challenges

Three unrelated articles in the past 24 hours have reinforced my anecdotal observations of the current situation faced by many mid-size industrial manufacturers.

Three unrelated articles in the past 24 hours have reinforced my anecdotal observations of the current situation faced by many mid-size industrial manufacturers.

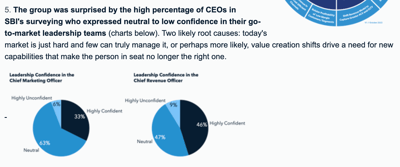

- CEOs don't have confidence in their sales and marketing leadership's ability to grow revenue. A recent Sales Benchmark Index survey of CEOs found 56% are not confident in the CRO's ability, and 69% lack strong confidence in their CMO's ability to drive results.1

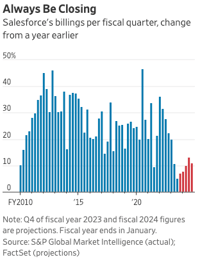

Salesforce.com, the "company founded by salespeople to make software for salespeople is in the midst of the worst sales slump in its history."2 And that's for a company that spends "45% of its trailing 12-month revenue on sales and marketing costs alone" compared to the average 16% spent by other companies on the S&P Software & Services Select Industry Index that generate more than $10 billion in annual revenue. In my experience, the pressures growing for middle-market industrial manufacturers are even stronger, if not yet fully recognized.

Salesforce.com, the "company founded by salespeople to make software for salespeople is in the midst of the worst sales slump in its history."2 And that's for a company that spends "45% of its trailing 12-month revenue on sales and marketing costs alone" compared to the average 16% spent by other companies on the S&P Software & Services Select Industry Index that generate more than $10 billion in annual revenue. In my experience, the pressures growing for middle-market industrial manufacturers are even stronger, if not yet fully recognized.- 82% of CFOs responding to Grant Thornton LLP’s CFO survey for the fourth quarter of 2022 plan to "increase investment in demand generation, with six in 10 saying they will raise spending by 6% or more....CFOs need not be involved in demand generation tactics, they are expecting to see quantifiable performance out of the marketing, sales and customer functions. This extends to understanding how alternative approaches such as disruptive marketing and customer technologies can create value, drive measurability and enable maturation of demand generation capabilities." Further, CFOs are asking whether "organizational capabilities and go-to-market motions are mature enough to respond to shifting customer expectations."

On the one hand, sales have been strong, and CEOs and CFOs have been preoccupied with supply chain and talent challenges. Sales and marketing haven't been their highest priority.

That's changing. There's a gradual awareness growing that they may not have the right people, skills, or processes in place to overcome slow growth in today's market conditions. Buyers have very different expectations for experience and engagement than when many mid-size manufacturers implemented their current models.

But that awareness creates angst because it's an uncertainty that's not offset by clarity into how to change, and normalcy/recency biases create enormous inertia to overcome.

Nobody Knows for Sure - Market, Managers, Executives or Directors

There is no "settled" revenue growth science. As B2B buyers change, their B2C buying experiences influence their B2B expectations, buying teams grow, technology evolves constantly, and company priorities shift quickly, effective sales and marketing will constantly evolve.

There is no "settled" revenue growth science. As B2B buyers change, their B2C buying experiences influence their B2B expectations, buying teams grow, technology evolves constantly, and company priorities shift quickly, effective sales and marketing will constantly evolve.

After all, when even Salesforce.com with its massive budgets and long track record stumbles, it's clear that things are changing and it's no longer easy to increase revenue.

That means experimentation for specific products, markets, ICPs, and buyers. It means iterative efforts.

It doesn't mean standing still until something is clearly broken or until there's a clear solution.

The problem for most privately held manufacturers is that nobody knows how to quantify their baseline or where to begin experimenting.

Sales and marketing leadership, unlike their engineering and manufacturing counterparts, is often installed and promoted because things are OK rather than because of meaningful credentials and documented continuous improvement.

Sales and marketing leadership, unlike their engineering and manufacturing counterparts, is often installed and promoted because things are OK rather than because of meaningful credentials and documented continuous improvement.

Senior management often comes from technical and finance backgrounds, and even those with sales and marketing experience worked in those disciplines when market conditions were very different.

Boards of Directors are unable to provide satisfactory oversight of management because they rarely include independent directors with contemporary skills and insights into effective total growth.

That creates a crummy situation. There's concern and gradually growing awareness that something's going to break. There's no internal expertise to quantify the challenge or identify potential solutions. And there's no management context for considering what to do next.

Ugh.....

There's Good News for Manufacturers

The bad news is bad, particularly because it's so vague. But there's good news too.

The bad news is bad, particularly because it's so vague. But there's good news too.

The situation manufacturers face today with the potential dysfunction in sales is closely analogous to one they faced two decades ago in their manufacturing.

Most companies underwent a manufacturing metamorphosis - from making stuff and checking quality, to designing and continuously improving their process for making stuff. They engineered the quality and production planning steps. Quality improved as did output and on-time delivery.

Process engineering improved manufacturing.

Process engineering can improve the marketing and sales system.

Of course, that means some of the same disruption, uncertainty, and internal dissension they faced last time. Some long-time employees will resist, argue and challenge the change. Indeed some will be unable to adapt. That's both sad for companies and employees with long-standing loyalty, and a natural part of change.

Process Engineering for Business Growth

There's no doubt that growth initiatives are complex. The full panoply of steps from marketing ideation through measuring lifetime value is enormous. And there are functions that can't be as carefully controlled as certain mechanical manufacturing steps.

That doesn't mean, however, that the principles of process engineering can't be applied to most incremental steps and to the marketing and sales function in aggregate.

That doesn't mean, however, that the principles of process engineering can't be applied to most incremental steps and to the marketing and sales function in aggregate.

That's precisely what my proprietary ORE™ (Overall Revenue Effectiveness) framework helps companies to do. Learn more here and download a free diagnostic for your current operations here.

Implementing ORE will require the increase in budgets that CFOs are already funding.

And it will require more.

Owner, Executive, Director & Management Commitment

Everyone is going to have to come to grips with the challenge. That means awareness, mindset, and commitment to change.

Everyone is going to have to come to grips with the challenge. That means awareness, mindset, and commitment to change.

It also means that companies must ascertain certain things empirically. These include whether:

- The board includes executive and independent directors with the skillsets to provide appropriate marketing and sales oversight, fulfill the growth strategy, and manage senior leadership.

- A baseline (maturity model) for the company's current capability and performance - and specific priorities, goals, and timelines for improvement.

- Realistic assessment of senior management's credentials and capability to envision and execute the necessary changes.

- Accurate measurement of the sales team's ability to sell in today's market conditions (from senior VP/CSO down through each customer service and inside sales rep.)

Without these, any planning or discussions are simply exercises in ill-informed self-flagellation or self-soothing; neither of which approach the gravity of the moment.

That's why I'll soon offer a Board of Directors' BootCamp for Manufacturing Revenue Growth. The BootCamp will bring directors and executive management together to develop these baseline measurements and create a prioritized plan for success. If you're interested in learning more, please give my friendly chatbot 👉 your email address.

More Background on Business Revenue Growth

Over the past decade, many management teams, from small business owners to corporate leaders, have grappled with the challenge of growing their companies' revenue and market share. As businesses have expanded and more employees have joined their ranks, the need to optimize business operations and address revenue growth challenges has become increasingly evident.

Engineered Process for Revenue Growth

One of the key issues that growing businesses often face is the presence of inefficient processes within their marketing and sales operations. These inefficiencies can hinder productivity, increase costs, and ultimately impact the company's revenue potential. It's not uncommon for small business owners to find themselves in a position where they are so focused on the day-to-day tasks of managing their business that they overlook opportunities for process improvement. However, addressing these inefficiencies is essential for sustaining growth rates and staying competitive in the market.

For both new businesses and established ones, the quest for growth is a continuous journey. Whether you're looking to expand your customer base, launch new products or services, or increase your market share, it's essential to have a well-defined growth strategy in place. This strategy should encompass not only sales and marketing but also operations, finance, and customer service. In today's rapidly evolving business landscape, the ability to adapt and innovate is crucial for growing a business successfully.

Optimizing for Customer Success

One aspect that deserves special attention is the relationship with current customers. While acquiring new customers is vital for expansion, retaining and nurturing existing customer relationships is equally important. The value of loyal customers cannot be overstated, as they often contribute significantly to a company's revenue through repeat purchases and referrals.

To sustain growth rates and enhance revenue, it's crucial for businesses to continually assess their market position and competitive landscape. Understanding market trends, customer preferences, and emerging opportunities can help management teams make informed decisions that drive growth. In a fast-paced business environment, staying informed and proactive is essential for maintaining a competitive edge.

Technology to Scale Relationships with Prospects and Customers

As most businesses strive to grow, they must also consider their ability to scale efficiently. Rapid growth can sometimes lead to operational challenges, and management teams need to ensure that their business operations can adapt to increased demand and complexity. This includes evaluating and optimizing supply chains, logistics, and other critical aspects of the business.

Moreover, in today's digital age, technology plays a significant role in enabling business growth. Investing in the right tools and systems can streamline operations, improve customer service, and enhance overall efficiency. Many management teams have recognized the importance of digital transformation in staying competitive and meeting the evolving expectations of customers.

Growing is Like Making - It Takes Innovation

The journey of growing a business is filled with challenges and opportunities. From addressing inefficient processes to expanding market share, businesses of all sizes must navigate a complex landscape. By focusing on innovation, optimizing operations, nurturing customer relationships, and staying attuned to market trends, management teams can position their companies for sustainable growth and success in an ever-changing business environment. It's a journey that requires dedication, adaptability, and a keen eye on the future, but the rewards of achieving and sustaining revenue growth are well worth the effort.

2. WSJ on the "worst growth stretch in history" for Salesforce.com